These events are also an excellent opportunity to network with other professionals in the field. By understanding the cost of each customer, manufacturers can identify which customers are profitable and which are not and make informed decisions about pricing, sales, and marketing. Human resources managers are responsible for managing the organization’s workforce. They may assign costs to cost objects related to employee compensation, benefits, and training.

Traceable costs definition

- This can help them make informed decisions about whether or not to invest in a company and can provide insight into the company’s long-term financial health.

- Therefore, it is important to choose the most appropriate method for the specific purpose and scope of the cost analysis, and to be aware of the limitations and implications of each method.

- Businesses should regularly review their cost objects, cost drivers, and cost allocation methods, and make adjustments as needed.

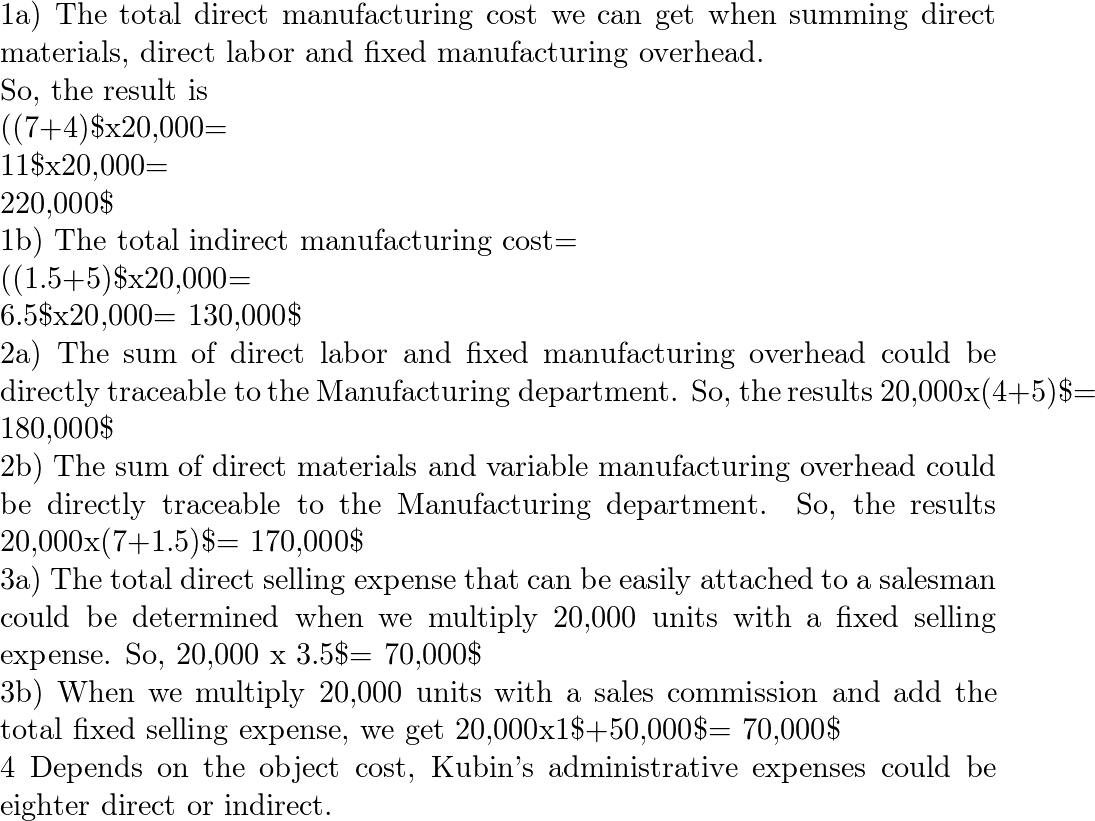

Correct allocation of direct and indirect costs leads to more accurate and transparent budgeting, forecasting and cash flow planning, as well as reporting for management and financial purposes. For example, factory overhead costs can be apportioned to each unit produced by the total number of products manufactured, or based on the number of hours it took to manufacture each product. This helps a company to calculate the overhead cost per unit so that prices can be set accordingly to ensure a profit is made on each product even after incorporating all indirect expenses. Combined, direct and indirect costs represent all of the expenses incurred to run a company’s day-to-day business operations.

Standard Costing – Techniques Used to Allocate Costs to Cost Objects

For example, a company is planning to eliminate an entire product line, and wants to understand which expenses will be terminated when the product line is shut down. The costs traceable to the product line include advertising expenses, a marketing specialist, a production line, and a warehouse. Categorization of cost objects supports the preparation of management reports and financial statements by enabling allocation of business transactions and events into the correct accounts. The traceable and common fixed costs can be mixed together when the company has many segments.

Direct Costs

Cost objects support a company’s profitability by helping to set appropriate pricing for its products and services and maximizing the profitability in each business segment. Regular cost object monitoring and analysis can help a company optimize cost spend, identify efficiencies and streamline operations over time. Common Fixed cost is the fixed cost that supports the business activities of the two or more business segments. It is the cost that is paid in total to cover all cost objectives in different business units, locations,s and so on. Proper cost classification will also come in handy when it is time to file a business tax return as some direct and indirect expenses may be tax deductible. Accordingly, the unit cost of production would be measured using the newest or oldest inventory items.

Operations Managers – Who Typically Assigns Costs to Cost Objects Within an Organization?

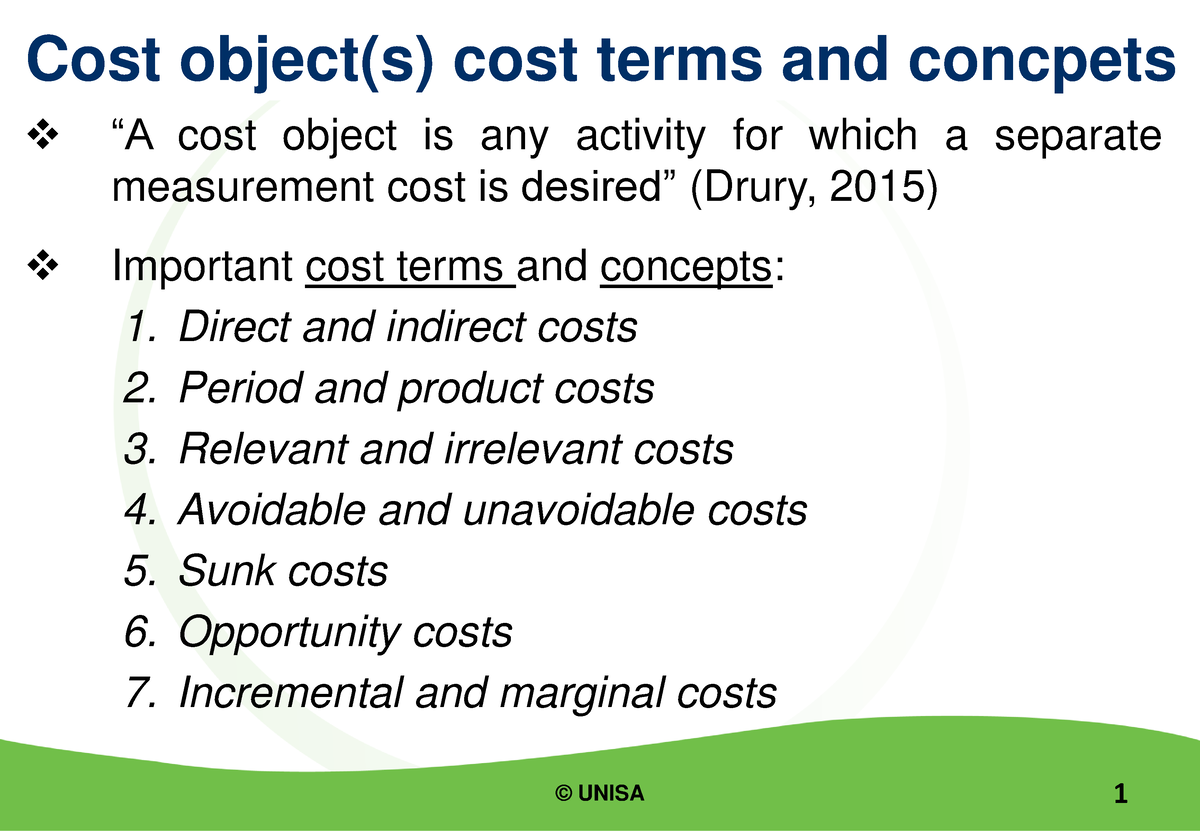

In this section, we will explore the concept of cost object in more detail and learn how to define and trace costs to a specific cost object. We will also discuss the benefits and challenges of using cost objects for decision making. This company defines each project as a cost object, and traces the direct costs of labor, materials, and software licenses to each project.

The hospital uses cost object information to measure the cost-effectiveness and quality of its services, and to comply with the regulations and standards of the health care industry. The hospital also uses cost object information to optimize its resource allocation and capacity planning, and to enhance its patient satisfaction and loyalty. In the production process of any manufacturer, accountants and managers want to be trace costs back to the thing that creates them in order to streamline operations and increase efficiencies. These traceable costs or direct costs are expenses that can be traced back to a single cost object.

For example, electricity costs may not be straightforwardly traced to a specific product as usage was shared by different departments. Managerial accountants use all of these costs and their cost objects to analyze activity based costing models and identify ways that the company can be more efficient. From a managerial perspective, cost objects can be classified into various categories, such as products, services, projects, departments, or even individual activities. Each cost object represents a distinct entity for which costs are accumulated and analyzed. In this section, we will delve into the concept of cost objects and their significance in cost accounting.

For example, it may not be possible or financially feasible to precisely determine how the activities of company directors benefit a particular product, service or project. This information can be used to make informed pricing decisions, as the company can determine the actual cost of each product and adjust the price accordingly to maximize profitability. These costs educator expense deduction refer to the money spent promoting or maintaining relationships with customers, suppliers, and other business partners. Cost tracing refers to the assignment of accumulated costs that have a direct relationship to a particular cost object. If most incurred costs are direct and traceable, then the manager is in a better position to understand and control these costs.

Sometimes management has to decide if it is economically feasible to determine if a cost is direct or indirect. It is because the expense of tracing the cost to a cost object may be greater than the benefit of having an accurate value for that cost object. Engines used in a Boeing 747 are easy to trace to each plane, and therefore the cost is easy to calculate. The salaries for marketing employees are easy to trace to the marketing department of a company. The cost of plastic used in production can be easily traced to the food containers. However, the cost spent for electricity is not directly traceable to the food containers since such cost was not used solely for the production of the product.